Tax stamp solutions

Governments lose around $40 billion from the illicit tobacco trade. The effects on industries and the businesses that operate within them can be devastating, as well as causing huge losses in tax revenue to governments.

OpSec’s programs around the world are proven to successfully combat this illicit trade, protect revenues and enable governments to meet their obligations under the FCTC ITP Protocol.

OpSec achieves this by combining banknote-level security features with our proven digital track and trace technology.

OpSec® Insight

Our complete digital tax stamp platform

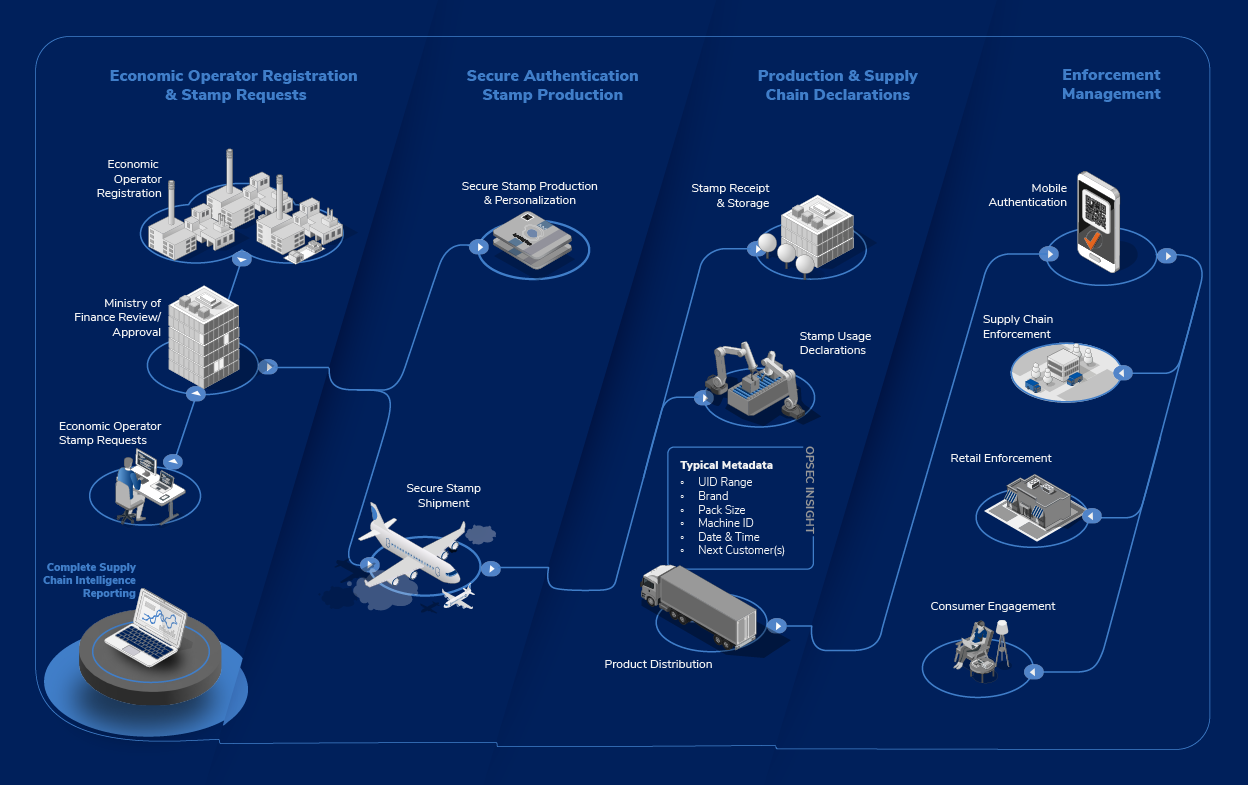

The OpSec® Insight platform provides an independent track and trace solution. This includes UID (Unique Identifier) request management, automated data collection, product aggregation, supply chain management, and enforcement reporting.

The first critical step in the implementation of a tobacco tax stamp traceability solution is a consultative approach to register all Economic Operator stakeholders within the supply chain, along with all associated operating facilities, production equipment, and retailer locations.

The Insight™ track and trace platform core functionality enables this process to be undertaken, approved and integrated seamlessly into the central Insight™ track and trace platform.

The Insight™ track and trace platform fully integrates with global tobacco factories, generating Unique Identifiers (UID) to ISO 15459 standard.

OpSec-issued UIDs enable unit pack to carton and master-case identification. These are already supplied to tobacco factories throughout Europe as part of the EU Tobacco Products Directive (TPD) program.

Utilizing the Insight™ API technology, supply of UIDs are requested, generated, and delivered automatically to global manufacturers – marking the start of the complete tobacco supply chain traceability.

OpSec’s proven production monitoring and control solutions have captured billions of tobacco UIDs on high-speed tobacco packing lines over the past decade.

With identifiers captured, checked, and activated in real-time, all local production data is then pushed to the central Insight™ repository for ongoing supply chain movement declarations and intelligence reporting.

The Insight™ platform can utilize aggregated tobacco identifiers to enable supply chain traceability from manufacturer, to wholesaler to distributor and first retail outlet.

Insight™ allows for product aggregation and de-aggregation either directly within the Insight™ platform or via integrations with leading warehouse scanning equipment and software.

All production and movement declarations are captured in real-time, along with the operator, required metadata, and geo-location of each activity, ultimately enabling mobile enforcement anywhere within the supply chain and business intelligence reporting.

OpSec provides security features for tax stamps to government clients worldwide, ensuring highly effective authentication of marked tobacco products.

This is achieved by combining banknote-level security features with OVD (Optically Variable Device) technology that provides market-leading security at overt, covert, and forensic levels.

OpSec provides full training to partners and government enforcement officials to ensure the ideal set of security features is chosen and to enable effective authentication anywhere within the supply chain.